Internet acquiring

We provide complete service of the accepting payments using all major debit and credit cards of international payment systems Visa, MasterCard and Mir from customers around the world on web, in mobile apps or social networks. Our clients are both companies taking their first steps in internet business and brands with many years of experience in the online sales.

We cooperate with the largest Russian and international acquiring banks, processing organizations and payment systems in Russia and abroad.

Our advantages

- The lowest and transparent tariffs, without hidden fees

- Transfer funds to your bank account the next business day

- Minimal set of documents to sign the agreement

- Technical integration is available immediately after registering on the website

- Personal account with online statistics and other necessary functions

Payment functions and solutions

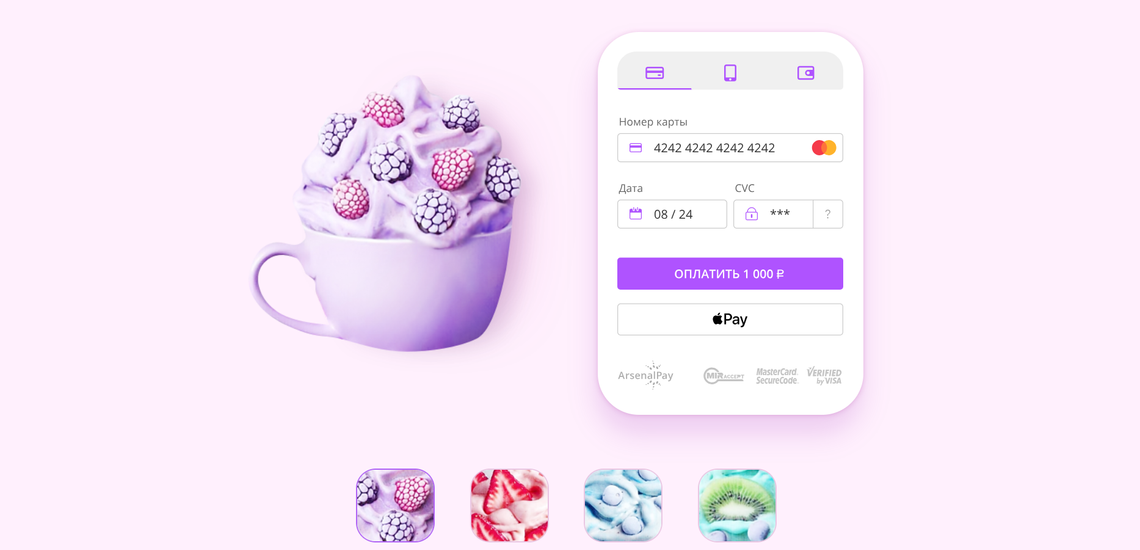

- Payment widget with no redirects and interruptions mean your customers never leaves your site, as a result is a smoother shopping experience and an increased conversion rate

- Customisable payment widget to match the look and feel of your website

- Saving card number for one click payments

- Recurring payments, subscriptions

- Preauthorization, two-step payment

- Split payments

- Mass payments

- Marketplaces

- SMS, Whatsapp and Telegram notifications and payment in the answer message

Create account to grow your business or to know more.

Mobile phone balance

Go beyond credit cards and support direct payments using mobile phone balance. All the top 4 mobile network operators in Russia are supported. MTS, Megafon, Beeline and Tele2 provide mobile services to more than 150 million people. 100% penetration of the payment method among people who has the ability to pay.

How it works?

- The customer enters the mobile phone number on the website.

- The mobile operator sends an SMS to the mobile phone with a payment confirmation code.

- After payment is confirmed, SMS is sent about successful payment.

Also, you can use mass SMS notification service with payment option. The service is used for both regular mass SMS notification and SMS with the possibility of payment in the answer SMS from the mobile phone account or a linked bank card. For example, send to your clients SMS with information about their balance. They can send answer SMS “OK 500” to pay for your service instantly.

Faster Payments System (SBP)

The Faster Payments System (SBP) is a service that allows individuals to make interbank transfers using a mobile phone number. It operates 24/7/365. Transfer fees are either low or zero. More than 200 banks, including the largest ones, are already connected to the system. SBP users can receive payments from organisations and pay for purchases using QR codes or other instruments.

SBP was jointly developed by the Bank of Russia and the National Payment Card System (NSPK). The Bank of Russia is the operator and settlement centre of SBP, and NSPK acts as the operations and payment clearing centre.

How to use:

- Using a phone number to transfer money via SBP

- Using QR code for making a purchase

- Using a phone number to receive payments from organisations

Integration POS terminal with CRM

Point-of-sale (POS) terminals are changing and for many businesses, there's no going back to traditional POS terminals. Technological advancements at the point of sale are making it easier than ever to run a business. Today's POS systems can do everything from processing credit cards using mobile devices to transmitting sales data to other software business already uses. Many POS systems now come with built-in customer relationship management (CRM) feature, but they are much less functional than the popular ones on the market.

By integrating POS terminals with popular CRM solutions, such as Bitrix24, amoCRM or Salesforce, business, by using POS data, can build solid relationships with customers and deliver the best customer experience possible, such as:

- Quickly capture customer information.

Real time transmission of the customer data to your CRM, such as customer name, location and bank card token linked with purchase data

- Analyse captured data (customer preferences and buying histories) and increase sales by improving the customer experience.

- Find the most loyal customers.

Combine captured data with loyalty programs, rewards systems and gift card functionality and customers will come back to you again and again.

- Synchronize with multiple departments.

Information is always updated, available anytime to staff members and will only require logging in to a single platform for access.

- Automated backend processes.

Like reporting, exporting data, creating client records or email marketing lists. There's no need to go into multiple programs to manually perform these functions.

Our company provides full stack of integration POS terminals with your CRM, billing or other accounting system, safely processing sensitive customer card data in accordance with the Payment Card Industry Data Security Standard (PCI DSS).

Buy Now, Pay Later

Online credit application solution for e-commerce merchants who wants to give shoppers the choice to buy now, buy now and pay later or pay after delivery.

By using beautiful and tailored for online business technology to make real-time credit assessments, you can increase consumer purchase power, improve loyalty and average order value. No risk for the merchant, they receive payment from ArsenalPay immediately.

How it works?

When choosing ArsenalPay’s buy now and pay later option at checkout the merchant ships customer order. At the end of an interest-free time period specified by the retailer, customer then need to decide to either pay off the entire purchase in full or start paying monthly with interest.

Advantages for the customers

- The ArsenalPay credit application is quick and easy. We request minimal information and the decision is made in real-time. It does not require visits by couriers or copies of documents.

- The customer gets the opportunity to pay for the goods after delivery without interest.

- Favorable loan terms, comparable to bank products.

Advantages for the merchants

- Service is completely free for the merchant

- Monetize additional traffic (not enough money, not valid bank card, etc) and boost your sales 10%.

- Increase in the turnover of goods, indirect lending to the trading platform (the merchant receives money for the goods at the time of the order, without waiting for delivery to customer).

- A high ratio of loan approvals - 6 out of 10 who apply for a credit, receive it. Approval rate is higher than banks has.

- Single point integration using ArsenalPay. There is no need to spend a technical resource of the merchant.

Customer notification service

Send notifications to your customers, smartphone owners, who use WhatsApp, Viber, Telegram, iMessage or other messengers. Dramatically reduce your costs for sending SMS. Decrease the load on the call center with the help of a chatbot that answers frequently asked questions.

Key features

- Customers notification through messengers is much cheaper than SMS.

- No need to install any additional mobile applications. Some companies have their own mobile applications with push notifications, but their penetration among customers is much less than 100%, unlike messengers that all smartphone owners have.

- Messages are delivered instantly, without any delay from mobile operators.

- In addition to sending usual text messages, you can send photos, audio and video files, contacts and location.

- Attraction of the client's attention is much higher, in comparison with SMS.

- We know the status of the message delivery to the smartphone. If the message will not be delivered, we will send the customer the usual SMS.

Notification cases

- Suitable for sending one-time passwords, transactional notifications, bank card or bank account balance notifications, notifications of credit application approval.

- Send photos of goods with the possibility of online purchase or the link to the product page.

- Send notifications about the status of the order, when the customer did not leave the mail, but only the phone number.

- Congratulate on holidays, remind about various events or talk about company news, notify on sales and discounts.

Chat bot

- Provide customers with a free opportunity to receive answers to typical questions. For example, to find out balance or order status in an online store, sending commands “balance”, “status” and so on. Teach the chatbot, reducing the load on the call center.

- Notify about approaching the zero balance with the possibility of instant payment in the response message. For example, “Your balance is 1 USD. Internet access will be closed in 3 days. Send “ОК 20” in response message to topup account on 20 USD.” The customer makes an instant payment in the reply message. Money is deducted from the balance of his mobile phone or a linked bank card.

Identifying the mobile operator by phone number

With the help of this tool you can determine the country, city or mobile operator by phone number (MSISDN).

It can help businesses better organize their client databases with relevant information about phone numbers and mobile operators. To send notifications to your customers using paid and free texting services require to enter a phone number as well as the mobile network operator name in order to successfully deliver SMS messages. If you specify the mobile operator incorrectly, the notification is not delivered and you get unnecessary expenses. The same situation with payments, when service need to send money to customers using mobile number as identification.

The situation is complicated by the fact that the mobile number portability is widely implemented across the globe. Mobile Number Portability (MNP) is an international standard in mobile telecom. It enables mobile telephone users to retain their mobile numbers when changing from one mobile network carrier to another. For example, in Russia, according to the Ministry of Communications of Russia on June 23, 2022, the number of mobile numbers transferred between operators exceeded twenty three million. Mobile numbers of Russia are identified based on data including the daily updated database of the transferred numbers (MNP).

Using this feature you can reduce costs to send notifications to your customers and improve usability of your services.

Other useful services for financial companies you can find on ArsenalPay.ru.